Save Smarter: How to Grow Your Money Faster with a High-Yield Savings Account

With the cost of gas, groceries, and homes rising, saving money isn’t just a smart move—it’s a must. In times like these, you need to make your money work harder for you. A simple and secure way to do this is by opening a high-yield savings account. Let’s dive into why this is a solid financial choice that can help your money grow faster over time.

Why Saving Money Is So Important Right Now

With inflation on the rise, your money is losing value by sitting in a regular savings account. Home prices continue to climb, and for many, everyday expenses like car repairs, school supplies, and vacations are becoming pricier. So how do you protect your hard-earned cash in this climate? The answer is simple: SAVE SMARTER!

A high-yield savings account allows your money to grow faster without taking on the risk of stocks or real estate investments. It’s a safe, reliable way to grow your savings over time.

What Exactly Is a High-Yield Savings Account?

A high-yield savings account offers much higher interest rates than a traditional savings account. This means your money grows faster—and it’s risk-free.

While stocks and real estate can provide high returns, they come with significant risk. A high-yield savings account, however, is secure and lets you access your money when you need it.

Why You Should Consider a High Yield Savings Account

Here’s a breakdown of the key benefits:

- Higher Interest Rates: Traditional savings accounts offer tiny returns, but high-yield accounts can offer up to 4.50% APY or more (variable), which means your savings grow at a quicker rate.

- FDIC Insured: Your money is safe, protected by the federal government.

- Easy Access: You can manage your account from anywhere with mobile and online banking, so your money is always within reach.

With inflation still affecting the cost of everyday life, this is an easy way to make your money work harder for you without any risk involved.

High-Yield vs. Regular Savings: A Simple Comparison

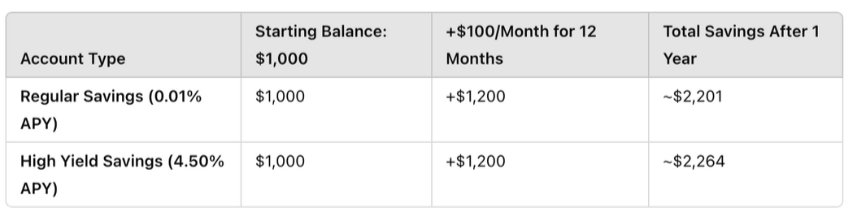

Let’s take a look at how much you could earn in both a regular savings account and a high-yield savings account with an initial deposit of $1,000 and $100 monthly contributions over a year.

In this scenario, with a high-yield savings account, you could earn an extra $63 by the end of the year.

Why That Extra $63 Matters

You might be wondering, “What’s the point of earning an extra $63?” The truth is, it’s money you didn’t have to work for. It’s the result of letting your savings grow at a better rate. Even small amounts like this can add up over time, and you’re not doing anything extra—just making a smarter choice with where you park your money.

High-Yield Savings vs. Other Investments

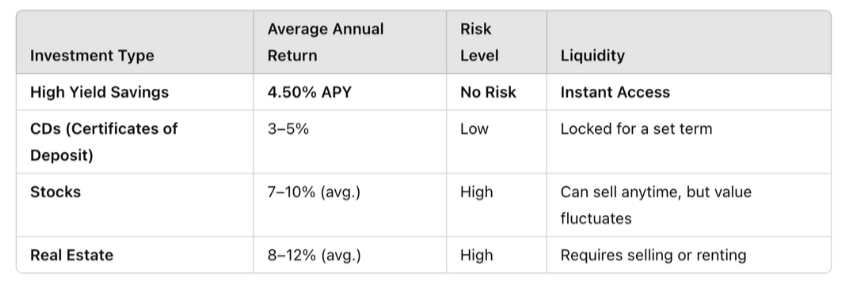

Let’s compare the annual returns of different investments to show how a high-yield savings account stacks up:

High-yield savings accounts offer a lower return, but they come with no risk and immediate access to your funds. Compare this with the higher return potential of stocks and real estate, which also carry greater risk and less flexibility. With a high-yield savings account, your money is safe, and you can access it anytime, whether it’s for a down payment on a home, an emergency fund, a home repair, or that vacation you’ve been dreaming about.

How This Helps You Reach Your Goals

Whether you’re saving for a down payment on a house, a much-needed vacation, or an unexpected car repair, a high-yield savings account can help you get there faster. It’s an easy and safe way to grow your savings and prepare for your future goals—big or small.

Ready to Start Saving Smarter?

If you’re ready to take the next step and make your money work harder for you, opening a high-yield savings account is a great place to start. Right now, you can earn up to 4.50% APY for 3 months with a qualifying deposit with Betterment.com.

Disclaimer: I’m a client of Betterment and, if you fund a new account, I receive compensation for this referral. You can see what others say about Betterment in reviews in the App Store and Google Play Store.

GET MORE INFORMATION

Royce Williams

Global Real Estate Advisor | SL3246689

Global Real Estate Advisor SL3246689